elements that are part of a flow of funds are basically the following: income, investment costs, operation and maintenance and salvage values. So there are other elements that can affect the flow of funds from a project, such as depreciation, depletion of intangible assets and depletion of natural resources.

1.

income revenues are included in cash flow are obtained through the sale or rental of goods or services of the project. Must be recorded in the year they expect to receive, regardless of when they are incurred.

1.

income revenues are included in cash flow are obtained through the sale or rental of goods or services of the project. Must be recorded in the year they expect to receive, regardless of when they are incurred.

It should be noted that revenue in the cash flow of the project should include both operating income (whether from the sale of the finished product or service delivery) and financial income (for example, for investment of reserves).

It is possible that some projects do not generate any income, do not produce any products or services tradable. Also create projects that simply change the way of producing a particular good or service, without changing the income received from its sale. The financial evaluation of these projects is still important for two reasons: first, to fill out a detailed profile of costs so that you can develop an investment plan and financing, and 2 to compare project costs with other alternatives to ensure that is done in the most efficient way possible, that is most convenient for the investor.

2.

Project costs are usually classified into two broad categories: investment costs and operating costs. For purposes of proper preparation of cash flow will be necessary to study the handling should be given to the dead and the costs of opportunity costs.

2.1 The investment costs

The first major category of costs that should be included in the assessment of a project are those of investment or production of it.

investment costs generally consist of outlays for the acquisition of nominal assets or assets and working capital financing. Acquisition costs Fixed assets represent disbursements for the purchase of land and buildings: the payment of civil works, and purchase of equipment, machinery and works of installation or support. Costs for nominal assets are investments in intangible assets, but needed to make the project work: patenting and licensing, technology transfers and technical assistance costs of formation and organization, and also the costs of training and training.

investment costs generally consist of outlays for the acquisition of nominal assets or assets and working capital financing. Acquisition costs Fixed assets represent disbursements for the purchase of land and buildings: the payment of civil works, and purchase of equipment, machinery and works of installation or support. Costs for nominal assets are investments in intangible assets, but needed to make the project work: patenting and licensing, technology transfers and technical assistance costs of formation and organization, and also the costs of training and training.

Finally, investments in working capital reflects the funds must be committed to achieving short-term assets and inputs for the production cycle, necessary for the operation of project. Within this area are basically cash and inventories (both inputs and raw materials and final product). We must distinguish between stock and working capital requirements and investment in working capital (or change in stock) that is what is recorded in the cash flow and cost. This reversal or at least a part of it is retrieved later (at the end of the life of the project), recorded in the flow with a positive sign, as income.

investment costs are not deductible taxes directly. These costs are not deducted when they are paid and are not recorded in the flow of funds and securities tax deductible. Is depreciation deduction that allows asset values \u200b\u200bnet taxable income annually, but in periods after the investment outlay.

2.2 The Operating Costs

The second major category of cost is for operating costs, consisting of payments for inputs and other items necessary for the production cycle of the project over its operation.

These costs can be classified as production costs, sales, administrative and financial. These, in turn, can be disaggregated, inter alia, labor costs, raw materials and supplies, leases and rentals and financial costs and taxes.

Operating costs are recorded in the period of the respective disbursements occur (cash accounting).

In any evaluation, it is necessary to distinguish between operating costs that are deductible from income tax and not deductible. Where most of them are deductible, any cost that is not register with the flow of funds in a manner different from other costs.

Generally, the estimated project cost also includes a category for "incidental."

2.3 The Costs Dead

is important not make the mistake of including dead cost on the flow of funds. These costs are defined as already done, which are inescapable, regardless of the investment decision is taken.

In other words, they are unavoidable costs, but decided not to make the project being evaluated. Such as proposing a bill that would increase the productivity of agricultural land, it engages a multidisciplinary team to design the project. They propose two possible projects and charge $ 100,000 for his advice. The proposed project costs include labor, equipment procurement, civil works and operating costs. These are avoidable costs and which are not paid if not done the project. In contrast, the $ 100,000 paid for professional advice represent an unavoidable cost, or cost dead, that in no way change the fact that professionals charge for their work, ie the cost of the advice has to be paid. As a result, should not be recorded as cost of the project.

costs is clear that death should not be included in the cash flow of a project. However, these can influence the flow, to the extent that the depreciation of fixed assets, natural resource depletion and amortization of intangible assets affecting the payment of taxes for a project, for this reason, it is indispensable establish the carrying cost of the items considered dead at the beginning of the life of the project and determine the amount of depreciation, depletion or amortization thereof, and applicable taxes. However, always essential to ensure that you compare the situation with project and without project, giving only the differences.

2.4 The Opportunity Cost

The opportunity cost is defined as the value or profit generated by a resource in its best alternative use. If the opportunity cost of an input used by the project is different from its acquisition price, then cash flow should be assessed according to the first.

's often presents an opportunity cost when the input used by the project is not acquired solely for him and have alternative uses.

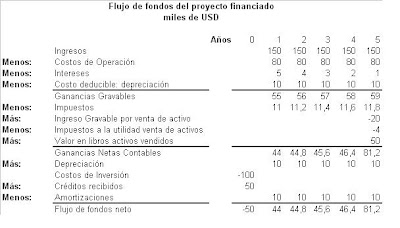

Funds flow financing, ie flow of a project funded:

Funds flow financing, ie flow of a project funded:  BIBLIOGRAPHY

BIBLIOGRAPHY  FUNDED PROJECT FLOW

FUNDED PROJECT FLOW

CASH FLOW AND INVESTMENT DECISIONS

CASH FLOW AND INVESTMENT DECISIONS