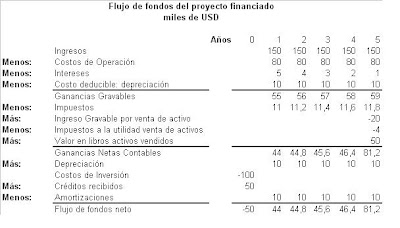

A project will be done in a country where there is no inflation. Requires a total investment of $ 100 million: half for depreciable assets and the other for non-depreciable assets.

investment is made in period 0. The life of the project has an implementation period of five years and depreciable assets have no salvage value. The loss on sale of other assets, which amounts to $ 20 million, will be charged to last period.

investment is financed at a 50% equity and 50% with a loan. This $ 50 million loan is amortized in five equal installments of $ 10 million each from the period 1.

The interest rate on this loan is 10% annual percentage yield on balances past due. Sales are $ 150 million per year and operating expenses excluding financial expenses and depreciation are $ 80 million per year.

rate income tax is 20%.

Depreciation is performed on 100% of the acquisition value of depreciable assets over a period of five years, with the method linear.

PROBLEM SOLUTION

Cashflow without funding, that is pure flow of a project without funding:

BIBLIOGRAPHY

BIBLIOGRAPHY

1. Nassir Sapag Chain, Reinaldo Sapag Chain, "Preparation and Evaluation", Fourth Edition.

2. Ernesto R. Fontaine, "Social Evaluation of Projects", 12 th Edition

3. Karen Marie Mokate, "Financial Evaluation of Investment Projects", First Edition.

0 comments:

Post a Comment