Education Project Preparation

Learn how to make an educational project and what is the methodology to be adopted for the Preparation and Development Educational Projects.

1. Preparation of an Educational Project

An educational project should and must respond to the need to develop educational management. Educational Project is a management tool that allows the community to come up with solutions to educational problems and meet the needs of both curricular and pedagogical nature of infrastructure and school furniture.

To develop a project for an educational center, you have to take the following steps: Organize

-

management team in each educational unit. Develop

-

diagnosis educational unit.

-

Identify the main problem the educational unit.

-

Set the overall objective of the educational project.

-

Designing action plans.

-

prepare the general budget.

1.1. Diagnosis of Present Situation

diagnosis is imperative Education Unit (School, College, etc..) Aspects must be specified as:

1.1.1 Project Identification

-

Name and code educational unit.

-

Project Type: Integral and pedagogical processes.

-

Education Project Objective.

-

Term.

-

Name and Code of the educational units that will benefit.

-

Location.

1.1.2 Socioeconomic Characteristics

-

geographic location and accessibility of educational units, type and condition of access roads (attach map). Distances

-

educational units to the central educational unit, address, area or neighborhood of educational units.

-

Economic Characterization: main economic activities of the municipality, county, area or district where you will find educational units benefited.

-

Existence of services: water, sewerage (system, shed, well), electricity (red, panel, motor), telephone, transportation.

1.1.3 Legal and Institutional Aspects

-

Date shaping the educational unit.

-

Date of formation of the board of parents.

-

Name and address representatives of parents.

-

Date conformation of the management team.

-

Name and address of educational adviser.

-

name directors or managers of educational units from that year occupy the same position. Payroll

-

teachers (Item, age, specialty, etc.) Staff payroll (Item, old).

-

teaching and administrative staff by gender and specialty.

1.1.4 Core Features School

-

Type of Schools form the core (central, branch, branch multigrade public convention, primary, primary, secondary).

-

Level shift cycle and educational units or network core.

-

Number of students per cycle and unit level education (preschool, primary, secondary)

predominant language - core

1.2 Educational Aspects

1.2.1 Teaching Curriculum

Current status of pedagogical curriculum, by level and cycle:

-

What skills, knowledge and common core curriculum skills are being built with students and in which there are difficulties?. This must be analyzed in each cross-cutting theme and from different areas of knowledge: i) language and communication, ii) Mathematics, iii) Life Sciences iv) Technology and know-how, v) expression and creativity, vi) ethics and religion moral, vii) physical education.

-

Attitudes that develop in students.

-

linguistic approach.

-

staff training levels.

-

Methodology and form of organization the classroom.

-

type activities.

-

Materials used in the classroom.

-

teaching support materials.

1.2.2 Infrastructure and Educational Furniture

In this section, we want to know the current state of infrastructure and educational furniture educational unit. 1.2.2.1 Real

Educational

inventory is made of educational goods distributed in the different raids, according to the following details, interested in knowing the current state of the same:

1.3 Identifying the Problem of the Education Unit

The management team identifies the problem of the educational unit from the identified problems in every aspect analyzed in previous sections such as:

1.3. 1 Identification of Problem Teaching

Once the participatory assessment is completed and has identified the main problem, the situation is projected without project. This step means, analyze existing resources: educational, infrastructure and school furniture and educational goods. That is, if an optimal allocation of those that does not involve major investments, it is possible to respond to problems identified.

In the absence of a marginal solution, ie that the problem can not be resolved despite the best allocation of resources, it justifies the project design.

To identify the most important educational problem, are ordered by their importance and is selected by consensus that it is common. We suggest the following steps: Note

-

problems common in the educational unit.

-

For each problem, consider the following aspects:

-

Who (students, teachers, principals, community) and how many are affected?

-

What areas of learning affects or how it affects the quality of the educational process?

-

How long is deemed necessary to resolve it?

-

What resources are available to solve it?

-

What other resources are needed?

-

What are the consequences if not resolved the problem?

-

Each of these aspects, we must assign a score.

-

The problem with the highest score is considered the most important.

1.3.2 Infrastructure Problem Identification and Educational furniture.

Educational Projects for Nucleus, the management team and board of education:

identify, prioritize, hierarchy and consensus on the demand for infrastructure and educational furniture.

And according to the complaint must meet the real needs of the population in a participatory educational planning for the next five years.

1.4 Status "Without Project"

Once the participatory assessment is completed and has identified the main problem, is projected without the project. This step means, analyze existing resources: educational, infrastructure and school furniture and educational goods. That is, if an optimal allocation of those that does not involve major investments, it is possible to respond to problems identified.

In the absence of a marginal solution, ie that the problem can not be resolved despite the best allocation of resources, it justifies the project design.

1.5 Status "With Project"

a) Value of Objective General Education Project with the current educational policy.

To formulate the objective of the educational project, take into account the objectives of the Program on Education Reform and define: What is your contribution?

b) General Education Project Objectives and Indicators

The overall objective is formulated, should serve as a working guide to the designers and their management teams in implementing the project. Having been drafted to respond to the following questions:

- What is to be improved?

- Which groups of people will benefit?

- To what extent? (Meta)

- In what period? (Time)

To facilitate the assessment of the overall objective should be established with precision: the impact indicators, measurement units and targets.

c)

Target Population The target population is the same benefits directly to educational projects. Differentiate the population is required to be addressed and educational levels.

d) Alternatives Analysis and Selection

Once the most important problem of the Education Unit has been selected and identified The general objective of education, it is chosen instrument. The instrument allows to clarify the purpose and direct the activities of the action plan of the educational project.

To select the most appropriate to the educational project, an analysis of alternatives. This step is to assess and monitor the proposed instruments according to:

-

Further integration of the knowledge areas: language and communication, mathematics, life sciences, technology and practical knowledge and creative expression, religion, ethics and moral and physical education.

-

The use of more competencies and indicators.

-

responds to the particularities of each educational unit or combination of them while the pedagogical objective pursued by the community.

1.6 Description of Project

Educational Process Component 1.6.1

Once the project has been identified are applicable to the development of the project (Action Plan).

1.6.1.1 Formulation of the Objectives

specific objectives are formulated as follows:

for educational projects

-

team management (composed of teachers, parents and students) formulate specific objectives, one aspect: i) Teaching Curriculum, ii) learning resources and materials, and iii) Socio which will contribute to achieving the overall objective of the core and reflect their needs and interests.

-

Each specific objective should consider the goal or achievement, as well as human resources and time required for execution.

-

Each instructional unit or combination of them, made the specific objective of the plan of action which reflects the chosen instrument.

1.6.1.2 Preparation Action Plans

-

The management team developed action plans relating to aspects of teaching resources and materials, socio, from a menu of possible things to do.

-

This action plan shall consider: time, activities, sub-activities, teaching patterns, time, resources, responsibilities and indicators for assessing compliance and performance.

-

The team of each educational unit, prepare the action plan curriculum based learning element to the instrument selected from the main activity menu.

-

Each instructional unit or combination of them, will produce a single action plan that includes: time, activities, sub-activities, tasks, time, resources, responsibility, competence assessment indicators, compliance and performance.

1.6.1.3 Development of General Education Project Schedule.

-

The action plans will be organized in a general timetable that will identify the sequential and parallel activities in time.

-

can draw up the schedule in a Gantt chart, which specifies start-up, runtime activity, etc..

1.6.1.4 Development of General Education Project budget.

-

The team will prepare a budget for every aspect of component: educational curriculum, educational resources and socio-educational. The team will prepare the budget action plan curricular educational aspect, the budgets of the various educational units or combination of them, are added to form the network budget. The management team will prepare budgets and aspects of socio-educational resources, as well as the general budget of the network.

-

Each instructional unit or combination of them, develop your budget plan. The management team meets these assumptions and develops the core budget.

Component 1.6.2 Infrastructure and Educational Furniture

All infrastructure requirements of a network of educational establishments, must necessarily be enrolled in educational units, the same participatory manner and with all educational community has prioritized, hierarchical and consensual municipal educational demand.

-

What normally is subject to financing is: the construction of new classrooms, repair of existing and provision of school furniture. The furniture component of infrastructure and education, must necessarily be accompanied by a component of pedagogical processes.

-

Once the municipal education committee (represented by the municipality, district education management and district boards) certifies that the demand for network is included, and requests the municipal government, the drafting of the folders a final design, based on benchmark prices of the municipality.

-

management team, raises core participatory demand on the basis of a budgetary ceiling.

management team with the backing of the Municipal Education Committee based on the PBS presentation of infrastructure projects and school furniture provided by the national fund for social investment and productive investment cost estimates.

1.7 Evaluation of Educational Projects

When educational projects have been completed, each team presents its project management to a committee of Education approves the assessment phase and manages them to the council, the resolution Approval of educational projects.

1.8 Size and Location of Project

For educational project, the project size is determined by the target population or target population of interventions. While the location of the project, is the core of the educational units. 1.9

Technical Analysis Determine the consistency of the educational project from the standpoint of technical, organizational, socio-economic and financial.

1.9.1 Technical Feasibility Criteria for

i) Component pedagogical processes

ii) infrastructure and school furniture component

ii) infrastructure and school furniture component Demand each of the educational units should adequately meet the following basic relations) Student / classroom, b) student desk chair or table or c) positive rate of enrollment growth.

iii) Criteria for Organizational Viability

The organizational design of the project is to define the responsibilities for implementation, operation and monitoring of the activities of the Action Plans of the elementary schools in educational projects. According to the guidelines, the management of education projects are the responsibility of management teams.

specific aspects to be defined in the organizational design are

Act

- management team formation.

- Agreements to promote the core team work, interaction and commitment to challenges.

- participation and involvement of parents in the implementation of the educational project.

The requirement of pedagogical advisers and teacher education units to remain in the network core or at least during the implementation of educational projects.

iv) Criteria for Financial Feasibility

- Compliance with maximum amounts per project and set the regulator component. Compliance

- financial structure defined by the regulator of Education, primary and secondary (investment costs, operation, consulting and incentives for teacher).

2 EVALUATION PROJECT

2.1 Determining costs

ii) infrastructure and school furniture component

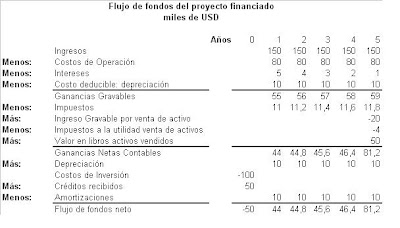

ii) infrastructure and school furniture component  Funds flow financing, ie flow of a project funded:

Funds flow financing, ie flow of a project funded:  BIBLIOGRAPHY

BIBLIOGRAPHY  FUNDED PROJECT FLOW

FUNDED PROJECT FLOW

CASH FLOW AND INVESTMENT DECISIONS

CASH FLOW AND INVESTMENT DECISIONS